Post

Break-Even Analysis: Formula and Calculation

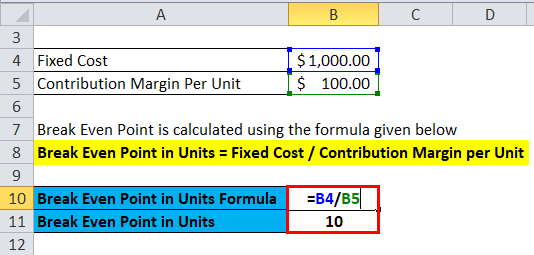

As businesses grow and production increases, they may benefit from reduced costs per unit, which can lower the break-even point. For example, buying raw materials in bulk might reduce variable costs, allowing the business to break even at a lower sales volume. The break-even point is the volume of activity at which a company’s total revenue equals the sum of all variable and fixed costs.

Financial Calculators

Once you have reached the break even point, any additional income generated after that point could be considered as profit. Simply enter your fixed and variable costs, the selling price per unit and the number of units expected to be sold. To find your variable small business tax credit programs costs per unit, start by finding your total cost of goods sold in a month. If you have any other costs tied to the products you sell—like payments to a contractor to complete a job—add them to your cost of goods sold to find your total variable costs.

How to Calculate the Breakeven Point

- It also assumes that there is a linear relationship between costs and production.

- The incremental revenue beyond the break-even point (BEP) contributes toward the accumulation of more profits for the company.

- At this point, you need to ask yourself whether your current plan is realistic or whether you need to raise prices, find a way to cut costs, or both.

- If you have any other costs tied to the products you sell—like payments to a contractor to complete a job—add them to your cost of goods sold to find your total variable costs.

Please go ahead and use the calculator, we hope it’s fairly straightforward. If you’d rather calculate it manually, below we have described how to calculate the break-even point, and even explained what is the break-even point formula. In contrast to fixed costs, variable costs increase (or decrease) based on the number of units sold. If customer demand and sales are higher for the company in a certain period, its variable costs will also move in the same direction and increase (and vice versa). Your variable costs (or variable expenses) are the expenses that do change with your sales volume. This is the price of raw materials, labor, and distribution for the goods or service you sell.

Create a Free Account and Ask Any Financial Question

Businesses share the similar core objective of eventually becoming profitable in order to continue operating. Otherwise, the business will need to wind-down since the current business model is not sustainable. There is no net loss or gain at the break-even point (BEP), but the company is now operating at a profit from that point onward.

If anything isn’t clear or detailed enough, please don’t hesitate to reach out. Our business plan for a mobile app will help you succeed in your project. This article was written by our expert who is surveying the industry and constantly updating business plan for a mobile app. Please review their policies, terms and notices for more information. MIDFLORIDA Credit Union does not operate or monitor their site, and is not responsible for the information, products or services offered. This means Sam’s team needs to sell $2727 worth of Sam’s Silly Soda in that month, to break even.

Can the break-even point be used to predict future profits?

The computes the number of units we need to sell in order to produce the profit without taking in consideration the fixed costs. However, it might be too complicated to do the calculation, so you can spare yourself some time and effort by using this Break-even Calculator. All you need to do is provide information about your fixed costs, and your cost and revenue per unit. To make the analysis even more precise, you can input how many units you expect to sell per month.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Our Break-Even Point Calculator makes it easy to understand your business’s financial situation and make informed decisions.

Quantifying the success rates allows those with drive and determination to push to achieve the highest levels which is great for personal achievement, financial reward and overall business success. Break-even sales volume is the amount of your product that you will need to produce and sell to cover the total costs of production. The break-even point can be affected by a number of factors, including changes in fixed and variable costs, price, and sales volume. Therefore, ABC Ltd has to manufacture and sell 100,000 widgets in order to cover its total expense, which consists of both fixed and variable costs.

The formula for calculating the break-even point (BEP) involves taking the total fixed costs and dividing the amount by the contribution margin per unit. Your fixed costs (or fixed expenses) are the expenses that don’t change with your sales volume. Some common fixed costs are your rent payments, insurance payments and money spent on equipment.